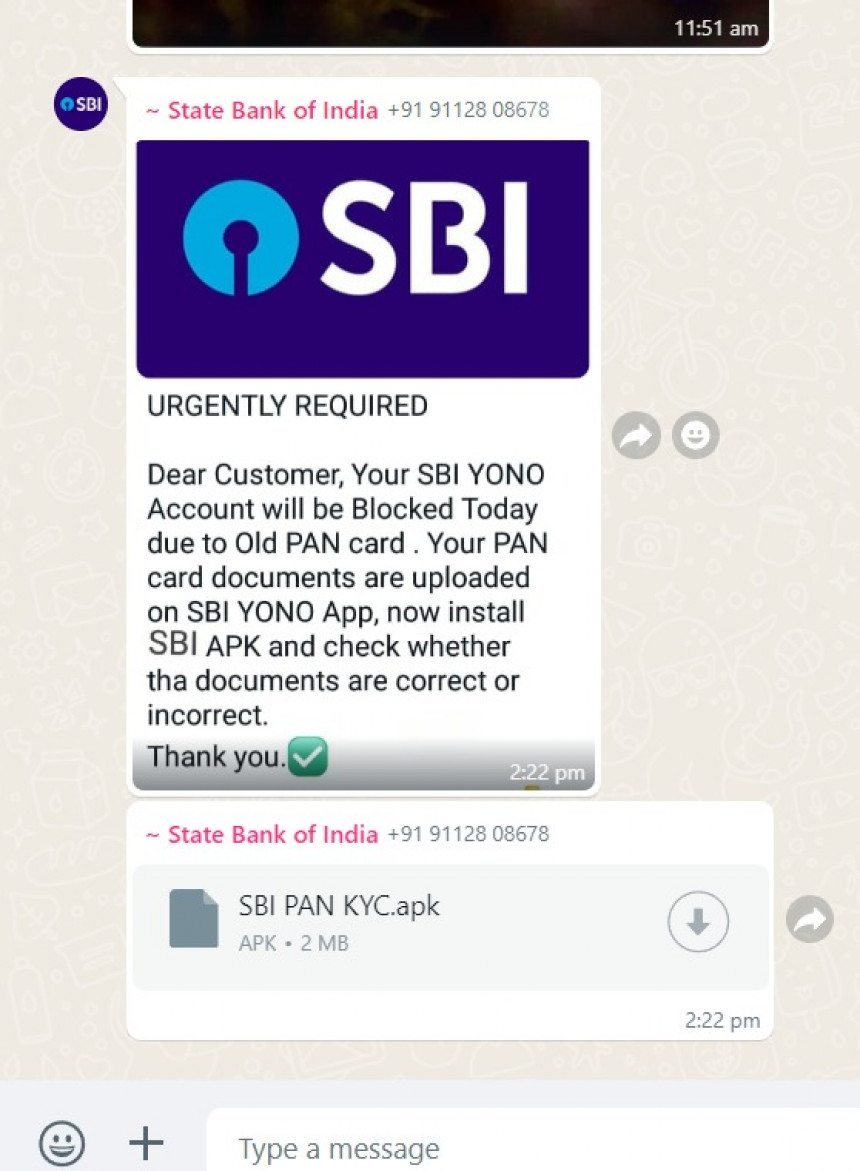

Beware of the Fake KYC Update App Targeting SBI Customers: Stay Safe from Scams

A new scam is spreading across India, targeting SBI customers with a fake app that claims to help with KYC and PAN updates. This fraudulent app mimics the official YONO SBI app, tricking users into sharing personal and financial details. Learn how to identify the fake app, protect yourself, and stay secure in this digital age.

In the ever-evolving digital world, scammers are becoming increasingly sophisticated in their methods to deceive innocent people. The latest scam spreading in India is a fake app pretending to be from the State Bank of India (SBI), designed to trick users into providing their KYC (Know Your Customer) and PAN details. This app falsely claims to be an official service that helps update personal information with the bank.

What Is the Scam About?

The scam revolves around a fake mobile application that looks strikingly similar to the official YONO SBI app. The app promotes itself as a tool to update KYC information or link PAN details with your SBI bank account. This is a common task that legitimate banks, including SBI, often ask customers to do for regulatory compliance. Scammers are capitalizing on this need, tricking people into downloading the fake app and inputting their sensitive information.

How Does It Work?

Once the user installs the fake app, they are prompted to enter their bank account number, ATM PIN, PAN details, Aadhaar number, and other personal information. The app may even send a fake OTP (One Time Password) to make the user believe it is a legitimate transaction. However, instead of updating the KYC, this information is transmitted directly to scammers, who can then use it to access your bank account, steal your funds, and potentially commit identity fraud.

How to Identify the Fake App?

- Check the Source: Always download banking apps from official app stores like Google Play Store or Apple App Store. Never trust links sent via SMS, WhatsApp, or unsolicited emails.

- Look for Red Flags: The app may have poor reviews, strange permissions, and spelling or grammatical errors. These are often signs of a scam.

- Verify with Your Bank: If you're unsure about an app or SMS claiming to be from your bank, contact SBI through their official customer service channels to verify the authenticity.

Protect Yourself from These Scams

- Never Share Sensitive Information: Banks like SBI will never ask for your ATM PIN, full card details, or passwords via SMS, calls, or third-party apps.

- Enable Two-Factor Authentication: Use two-factor authentication (2FA) on your banking apps for an added layer of security.

- Keep Your Apps Updated: Always keep your mobile apps, especially banking apps, updated to the latest version to protect against vulnerabilities.

- Report Suspicious Activity: If you encounter a suspicious app or suspect you've fallen victim to a scam, report it immediately to SBI and your local authorities.

Conclusion

As digital banking becomes more popular, the threat of online scams is growing too. By staying informed and vigilant, you can protect yourself from falling prey to such malicious schemes. Always verify the legitimacy of any app claiming to be from your bank, and remember, your bank will never ask for your sensitive information through unofficial channels.

Stay safe and help spread the word to protect others from this dangerous scam.